Coronavirus Insights Poll: Week 6 Results

Week In Review:

-

WOW, We're up by 50,000 responses in just 7 days, totaling 326,000+ small business participants to date. This poll reflects the true Voice of Small Business -- and it's all because of you. (So, please keep posting comments below, too. And thanks for sharing your stories!).

- Harvard Business School and others are now working with us to help analyze and publish your feedback, so we can hopefully channel more support in your direction.

-

Coronavirus Curve Flat Again: 85% report being impacted: same as last week.

- Slight Uptick: The number of small business owners who said they were "significantly impacted" increased by 2% from last week. But that's understandable, as the quarantines continue to diminish cash reserves.

- Receding Impact In States & Provinces: 2 weeks ago, 50% of states reported 90%+ impact. Now, that number's only 20% -- a promising sign?

- CARES ACT CONFUSION...

- 86% of small businesses that applied for CARES Act loans are in limbo, unsure what will happen next.

-

72% are awaiting approval.

-

14% have been approved and are waiting for cash.

- Only 8% have the cash in their bank accounts.

-

Major Media Outlets Hear You: USA TODAY covered your story.

-

Some Good News: We were so inspired by John Krasinski, we rebranded our video stories SGN Small Business Edition. Watch the inspiring video of Social Media Guru Tracey Davis, who says helping people now will make us all win. That's the small business spirit!

- With those sentiments in mind, let's remember to continue supporting each other through all of this turbulence. Together, we shall overcome. #SmallBusinessStrong

A Waiting Game & Anger At Big Companies For Most Of The Week

Big companies snapped up much of the $350 Billion from Round One of CARES Act funding. And public outrage continues to run high. Many people are pressuring large public companies to give that money back, so smaller companies can survive. Some have complied already.

On that note, a recent SBA interview showed that some of the nation's largest banks favored larger companies over smaller ones. Our Advice Forum is filled with stories of lending institutions making the process daunting and ultimately damaging to many small businesses. (You'll really want to read CARES Act Disaster: The Good, The Bad & The Really Ugly to see a broader perspective on the situation).

However, some small businesses did get their money from Round One, but often by relying on community or regional banks. We say it all year, "Shopping local is the way to go" -- not only for goods and services, but apparently for federal loans, as well. See these encouraging stories from our members for additional insider advice.

But At Week's End, Congress Finally Came Through -- Bolstering The CARES Act With Another $310 BILLION

On Friday afternoon, President Trump signed legislation to replenish the CARES Act with another $310 Billion for small businesses -- and $120 Billion of that was reserved for "the smallest of businesses." That's good news for sure, but go to your local banks this time, if you still haven't received your loans yet. The sooner, the better -- as who knows when this will run out!

We will have more details on this story next week, so tune in for updates.

This Week's Pulse Poll Recap

Holding Steady Around 85% For The Second Week

Some Pressure Lifts In Key States, Others Intensify

Last week, several states dropped off the Top 10 Most Impacted list. This week, that trend continues.

In fact, only North Dakota, New Hampshire, Nebraska and the District of Columbia had elevated impact scores. All other states saw a decrease from -1% to over -17%.

The biggest drops occurred in South Dakota (-17.6%), Arkansas (10.8%), and Mississippi (-10.4%). As you can see on the map, two of the lightest states are South Dakota and Oklahoma: the least impacted states in the U.S.

Meanwhile, Alaska continues to be the most impacted state with a score of 95.2%, closely followed by North Dakota (95%), Michigan (92.5%), New York (91.5%), and Vermont (91.2%).

We aren't out of the danger zone yet, but ingenuity and positive thinking are helping small business people to continue to weather the storm and stay vigilant, looking for any solutions they can find. Hopefully, this new batch of funding will help, as well.

Now, Let's Look At What's Happening In Canada

Here's Last Week's Map:

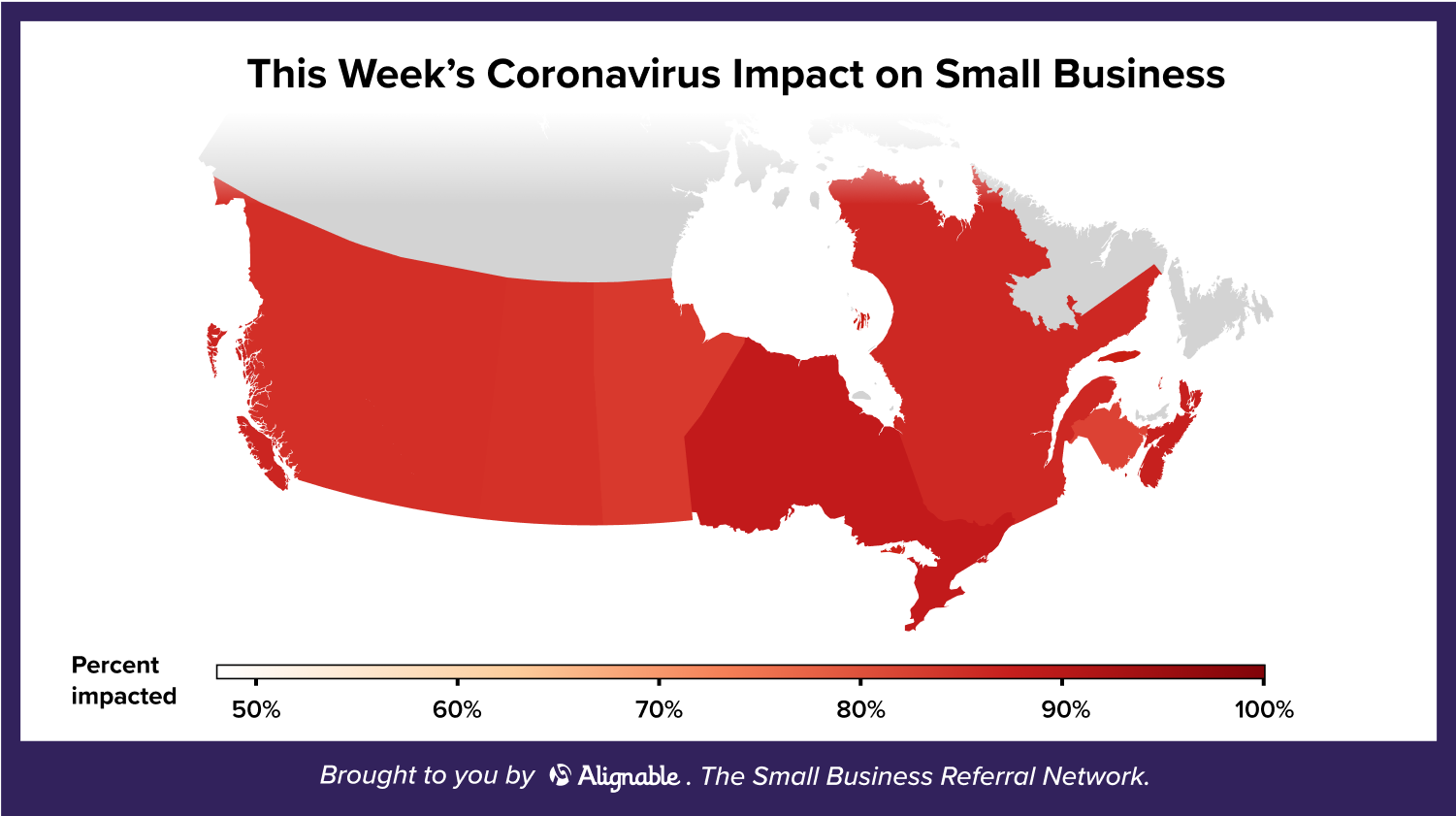

Here's This Week's Map: Everything's A Bit Brighter

Impact numbers that were once in the 90-100% range are now all in the 80-89% range. A positive shift is slowly emerging.

Manitoba and New Brunswick are two shining examples, both depicted in light orange on the map. Manitoba saw its impact score drop the most (-12%), landing at 75%. New Brunswick was right behind with a drop of -8%, down to 76%.

And even the most impacted provinces last week -- Ontario (91%), Nova Scotia (89.5%), and Quebec (89%) -- saw improvement. Now, Ontario is down to 86.5%, Nova Scotia is at 86.2%, and finally, Quebec comes in at 87.4%.

Those are still high numbers, but at least they're moving in the right direction.

No. 1 Concern This Week: Will More Small Businesses Actually Get The Funds They Need To Survive?

Along those lines, we're digging deeper, asking:

When did you apply for your loan and when did you get approved?

For those who were approved, how long did it take to get your money?

What bank did you use to apply for your loan & how was that experience? Would you use that institution again?

Do you believe the big businesses that were prioritized by large banks during the first round of funding should give the money back to help save smaller businesses with fewer resources?

We're also inquiring about paying May rent

Have you been able to negotiate better terms for your rent or mortgage?

Will you cover your full monthly payment or just a portion of it?

Is government funding you received a factor in your rent/mortgage payments?

Be sure to let us know how you feel about all of these issues, during our polls and also in any comments below.

And thanks for reading! Stay healthy and stay strong. #SmallBusinessStrong

Comments (1-10)

This last poll had too many questions im uncomfortable sharing due to privacy reasons, so i stopped in the middle.

I do not recommend sharing business confidential data in a poll.

Our business is down 75%. We did sign up for the payroll protection program to keep our employees going, however 1000.00 per employee only lasts a couple of weeks and so now what. It almost makes more sense to lay everyone off and shut our doors. Employees would be better off on unemployment. I am not interested in taking a loan out for the long term when the future is so unknown.

I'm still waiting to hear if I will get the EIDL loan from the SBA that I applied for almost 3 weeks ago. I couldn't apply for the PPP as I had to lay off my employees over a month ago due to lack of business. I can't afford a loan I will have to repay. My landlord was kind enough to let me wait on April rent until the first of May but I am unsure if I will be able to pay it. Business is very slow with orders trickling in. I am using whatever income I am making to pay small fixed bills. I agree with Governor Mills that we need to keep doing what we are all doing for a while longer. It's more important to me to save lives than to save my 46 year old business.

Yes I have been impacted. I am a one person business. My clients have postponed my coming into their homes or have completely canceled. I have a large festival this summer that would involve people watching severalvmuralists work and that is up in the air as well. I do advertising in Thumbtack and have gotten no inquiries for future work. This is ridiculous. Quarantine the elderly and vulnerable and let the rest of us go back to work. We have the “right” to work and earn a living.

My application was submitted to Bank of America on April 3 the first day we were allowed to apply. I was immediately denied due to the fact that I did not have a credit card thru BOA. Not a treasury requirement but a BOA policy. Ridiculous! Over the next 24 hours, BOA received thousands of complaints and changed their stance the next day. We reapplied then and given additional information over the next 3 weeks. At this point, we are still waiting for approval. Hoping for relief from Round Two of funding!

Ryan & Wood Distilleries is a small, Mom & Pop, batch craft Distillery in Gloucester MA. We transitioned into Hand Sanitizer production, all in, the moment the Federal Gov't (TTB & FDA) advised us to. We will be at a decline when we get back to production of Spirits, but, it is worth it to help keep our neighbors armed in this battle. Congratulations to all distillers who are doing this.

I applied 4/6 received money 4/23. I used Huntington Bank. Did not negotiate for less rent.

i do think that the big businesses that were prioritized and took so much of the finding should at least give a good portion back. It was presented as a small business loan to help those who do not have deep pockets.

I'm a home inspector most realtor are not showing home or the clients have taken there homes off the market. I get a insurance inspection from time to time . I've done 3 home inspection since this out break started. I signed up for unemployment but I still have not received anything I started that on 3/29. We have a broken system even though the governor keeps tell us he added people to this system . It time for him to add even more people to help with the processing of these foams

My business is closed until further notice. I am still paying rent. I give facials. Although I could wear a mask, there is no way the my guests could wear masks. Also, I am 79 and in the group that is confined to my home. Fortunately, I am actually retired, so the financial impact isn't drastic. Unfortunately, I am old and don't know how many good years I have left for working. I adore my work.

The virus has definitely impacted our business. I’m thankful that our management team has been positioning our company for a economic turn. We are not thrilled by any means with this problem but, we have really came together to face this challenge. We know things will have to change as a company and in our economic landscape but, we feel we are up for the challenge. In fact, we’ll come through this and we’ll be a even stronger company then ever before.