Mid-April Coronavirus Small Business Pulse Poll Roundup

Well, Our Stats Didn't Get Worse Over The Week

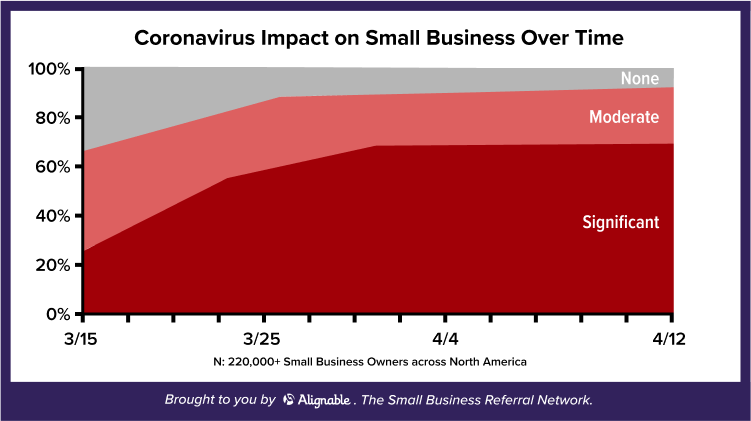

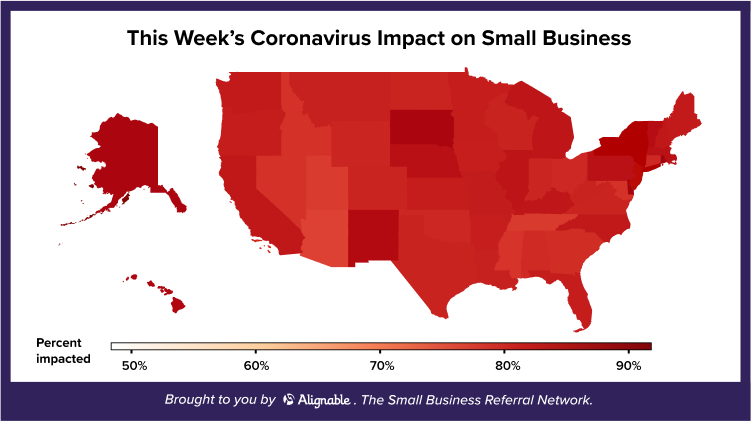

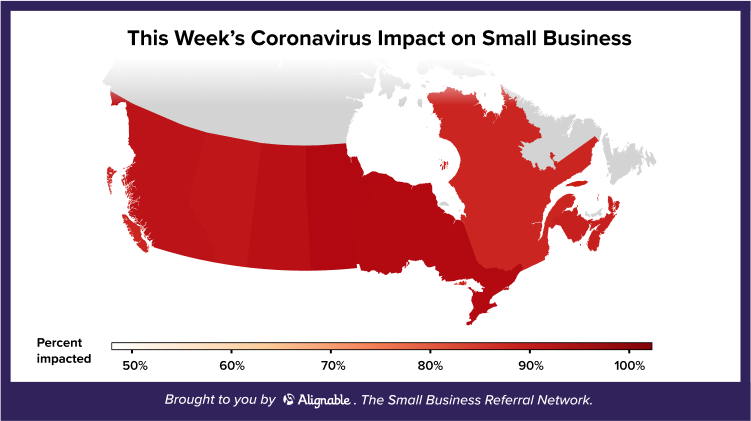

Last week, we told you we were starting to see signs of stabilization in our statistics. While it remains extremely rough out there with many states and provinces reporting that more than 90% of their businesses are impacted by the Coronavirus quarantines, we did witness even more stabilization this week.

The average impact across N. America actually dipped a few percentage points and about 20% of the states and provinces actually saw small percentage drops in their overall impact week over week.

We can't say if this really indicates a trend yet, as the overall number of businesses negatively affected remains astronomical. But there could be some nice rays of hope emerging. We certainly hope so, for everyone's sake.

Some additional facts & figures from this week:

- 220,000+ poll responses to date: Weekly Impact Poll

- 4,900 detailed comments have been made so far (click & scroll to the bottom of the page)

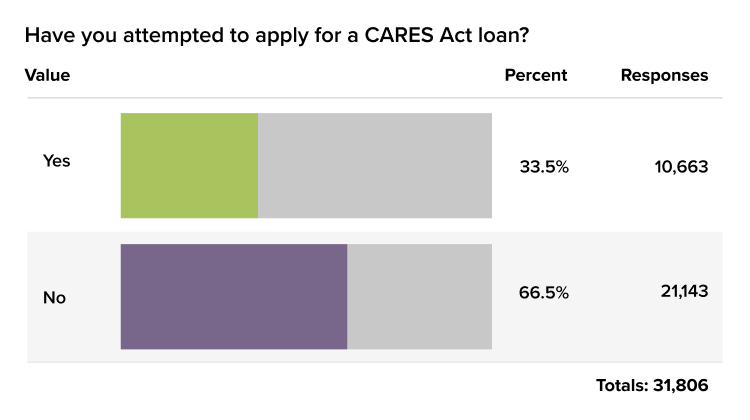

- Nearly 67% of small business owners told us they had not applied for CARES Act loans yet, citing several reasons in a poll we conducted with Harvard Business School. Reasons included distrusting the terms of the loan forgiveness provision, questions about whether they'd qualify for the loans, and whether or not money would show up in time. But early results from today show an increase for this coming week.

- We found ourselves in the middle of the national discussion around small businesses paying April rent for their closed stores and offices, as The Wall Street Journal asked us to create an exclusive poll for them. Click here and tell us what you think.

-

THIS JUST IN... SBA Regional Director Bob Nelson gave us the lowdown on how to get the loans you need and many other funding tips during a great interview with our Co-Founder Eric Groves. Watch their video as soon as you can. It will really help.

- And please be sure to read the latest articles on our Coronavirus Resource and Recovery Center. We're staying on top of the most pertinent information and advice out there to help all small businesses through this difficult period and the recovery, whenever that starts. We will get through all of this...together.

This Week's Recap

Impact Is Still High, But It Stopped Increasing

All States Are Highly Affected: Some A Bit More, Some Less

Canadians Still Feel It, But A Few Rays Of Light Shine

No. 1 Concern Of The Week: Bank Bottlenecks & Other Confusion Around The CARES Act

Read the article, "Should You Get A CARES Act Loan?" for more details around this situation. And the interview with Bob Nelson should help, too.

Questions We're Investigating This Week:

Who's helping you through this crisis beyond the federal government?

Over 50% of business owners say they are trying to get through this alone. That's not right. You have thousands of friends here on Alignable! We encourage you to reach out to your network if you're feeling isolated as many people want to lend a virtual hand or at least offer moral support, especially on Alignable. Of that, we're certain!

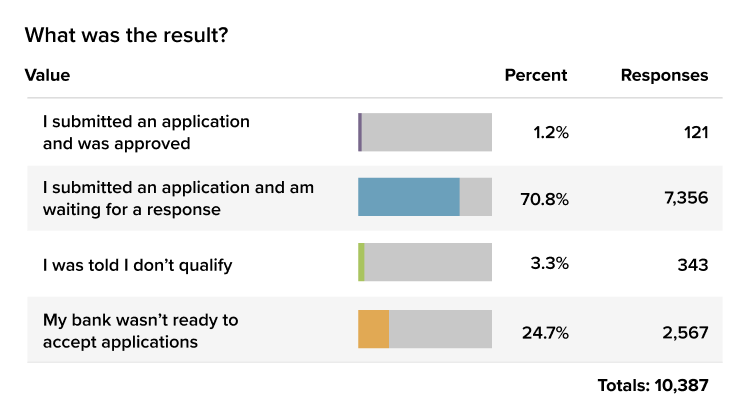

Now that we're going into Week 2 of CARES Act loan applications, are more people applying for the loans now and have some people even started to get money in their accounts?

At this point, it's all about the money and helping you get what you deserve, whether you have employees or you're flying solo.

Stay strong everyone and don't be afraid to ask for help. Chances are good many of you qualify for loans whether you've ever had one before or not. Please tap the assistance you need to keep your business alive, thereby improving your chances of an expedited recovery in the future.

#SmallBusinessStrong

Comments (1-10)

POW(pearls of wisdom) Substitute She for He as applicable.

He Who Knows-Not that He Knows-Not is a Child--Teach Him.

He Who Knows And Knows-Not that He Knows is Asleep--Wake Him.

He Who Knows-Not But Knows that He Knows is a Fool--Shun Him.

He Who Knows And Knows that He Knows is Wise--Follow Him.

Ignorance & Arrogance Are Double Deadly

Humility is An Antidote.

5 senses(sight,hearing,smell,taste,touch) I Help with Hearing.

6th Sense(common sense) Use it more.

BS(be safe)TIE(take it easy)

We are not wanting to take out loans when we have no idea how we’d pay it back or when we will be allowed to reopen?

The Coronavirus is impacting my business in a positive way, since I have developed a 2-step cleaning protocol using Bio-Organic Technology. Eliminates bio-films, and breaks down the lipid shell of the Coronavirus, the most effective and most environmentally responsible way to eradicate the deadly virus

The loan process is pretty easy long as you have all your documents in order as a business and the right bank relationship that will help you navigate the system. We were very prepared when I first heard about this. I had all my finance people pull all Related finance documents and Sam that I didn’t need just in case. We had everything ready to go by April 3 and paperwork got submitted on time. We were approved on April 7 by SBA and will close on 4/13. Trying to do it by yourself would be a nightmare and the frustrations that I have heard about ends up with people giving up.

We need to get back to work. A logical thing to do is set guidelines for businesses and if they can meet them, they can go back to work. Guidelines could include things like ensuring your employee have 6' of space between work-stations, have gloves and masks available, spray disinfectant on incoming products and materials, step up house cleaning by using disinfectant wipes on surfaces people touch regularly (door handles, phones, vanities, etc...), If you're sick stay home. Why is going to work so much more dangerous then going to the grocery store. If you use a few simple precautions, it's not. In Michigan, an independent business offering lawn services that has no employees can't work. That's crazy stupid. Let figure out how to get back to work fast before people, businesses, the economy is damaged beyond repair.

thanks for doing these polls and publishing the results.

i hope everybody is ok

All of my clients and most of my Alignable friends are on short hours or their business has shut down. As business owners, this is a great time for all of us to invest more time working on our business instead of in our business. It will pay huge dividends once this pandemic passes.

This is the perfect time to review every aspect of your business. What’s working? What’s not? Which processes can we improve on or eliminate? Are there changes we can make that will help our employees be more efficient and healthy? Are there slow-selling, low margin products we should eliminate? Should we add new products? And, most importantly, how do you plan to: #01.> Get your business up and running quickly and smoothly and #02.> Let your customer know you are open for business? Happy Planning! Wishing you the best, Darrell

I applied to my bank, Citizens, Monday, April 6 when they went live at 6:30pm. My application was in by 8pm. Today I received notice that I needed to upload my supporting documentation. When I applied, the rule at that time was not to include 1099 people, so I did not. When my bank asked me for supporting documents, they wanted 1099misc. I had asked the question to my bank, should I have included 1099 misc in the original app. They never answered. So now with that not included my loan request amount is lower. Can it be amended? Does anyone know. I did upload the 1099 misc info. This is such confusion and frustration. If you do get approved for any funds, be sure to set up a separate checking account for disbursements of the funds, for easy tracking for the forgiveness to be granted. What mess if you don't!

No customers but I still have to pay rent, utilities and other necessary services. It will take months to rebuild customer base and few will even have extra money to spend

This situation will take months even years to re-establish my business once I am able to reopen. Now Corporations continue to be the winners in this current situation.

We saw a rush of cancellations or early termination of leases for end of March and April, and suffered a big hit to our occupancy. We are not sure when travel or relocation will kick back in, so it is a waiting game. We take long term leases at properties as part of our business model and rent the furnished apartments out month-to-month to our business clientele. Since this all began, we have had zero luck negotiating discounts or lease breaks with the properties. We even offered to pay two months' penalty if they would waive the break lease fee (which can be about an additional $3000-5000/apartment), but no-go. We have been great renters for 15 years at many properties, paying about a $15 million in rent each year. I don't see myself staying committed to these properties who are not helping with any of this loss. We didn't hold our clients (including many Broadway or tv shows that were shut down during "shelter in place") to their leases because this was not their fault, but the big management companies are just raking in cash from us and other renters, with little concern. It is just disappointing to have so little empathy coming from large management companies, who will eventually feel the effects of this. Especially management companies with downtown properties, who will probably see a downturn in people wanting to live inside the city.