Coronavirus Small Business Poll Results Week Five

Week in Review:

- Thanks for Sharing: This is the Most Comprehensive Poll Out There: 278,000+ Small Business Owner responses to date: Weekly Impact Poll

- Nearly 5,000 detailed comments have been made so far (click & scroll to the bottom of the page)

- 51% applied for your CARES Act funding (up from 33% last week),

- 63% Still waiting for approval.

- 7% Approved and waiting for cash; and

- 2% Have the cash in their bank accounts.

- First round of cash runs out, hopefully those already approved will at least get their money...

- Harvard Business School dove deep in with our poll. It appeared in the prestigious Harvard Business Review this week. Be sure to look at the suggestions they add at the end of the article, which are especially insightful.

- Our members are getting creative. This video shows you how creative people can get! . Spoiler Alert: it's about a party planner who's now creating major tents for COVID-19 testing at regional hospitals. She saved her business and is helping to save lives at the same time!

- Finally, have you had a chance to visit our Coronavirus Resource and Recovery Center this week? If not, be sure to take a few minutes to see the new helpful articles we have there for you.

- We will overcome together #SmallBusinssStrong

It's A Roller Coaster Week, But Hold On Tight

We all know this week started out hopeful in terms of federal funding, now it's hit a snag with $349 Billion running out before many small businesses had a chance to apply for it. Hopefully, the government will boost the funding soon and we'll be back on track.

Either way, you can count on us to continue to give you suggestions to pull through this very difficult period by tapping our network for tips, connections, referrals and a community that wants to help everyone in it not just survive but thrive.

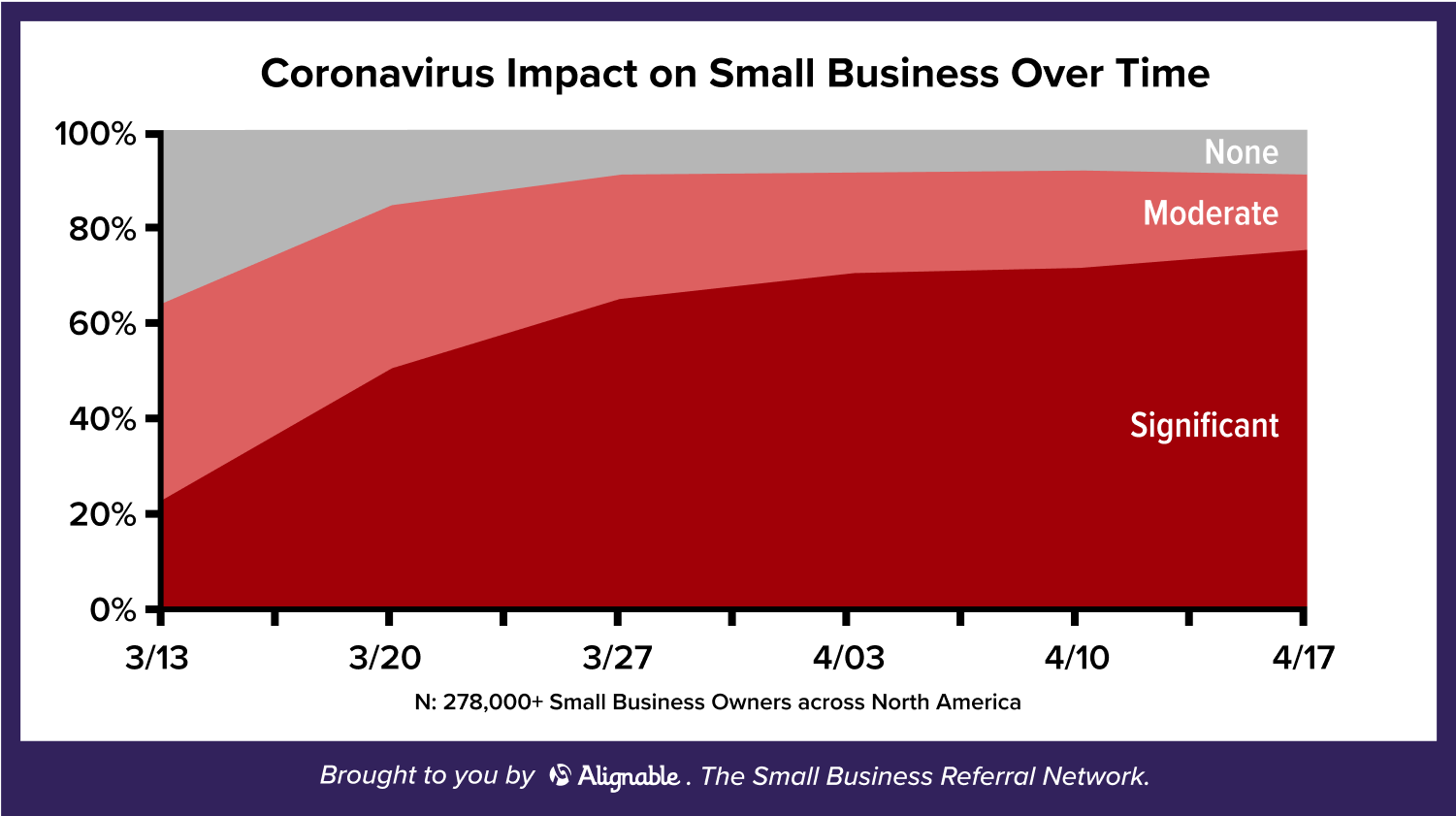

Shifting gears, we do have some positive news regarding our ongoing Pulse Poll. The impact of the Coronavirus threat has leveled out now and is five percentage points lower across N. America, dipping from 90% to 85%. Yes, the impact is still very prevalent, but at least as of this week, we are seeing some more signs of light at the end of a long tunnel in both the U.S. and Canada.

Last week, we told you that 20% of the states and provinces saw small percentage drops in their overall impact week over week. And we can report that 54% of states and 100% of the provinces saw dips in impact from .5% to as much as 11.5%. We've heard increasing reports of very creative pivots that are paying off for some people, and others that have been able to ramp up their online presence, making up for some of their losses or inventing an entirely new business.

This Week's Recap

Well, The Overall Impact Is Down By 5%

Effects Remain Widespread, But States Have Shifted

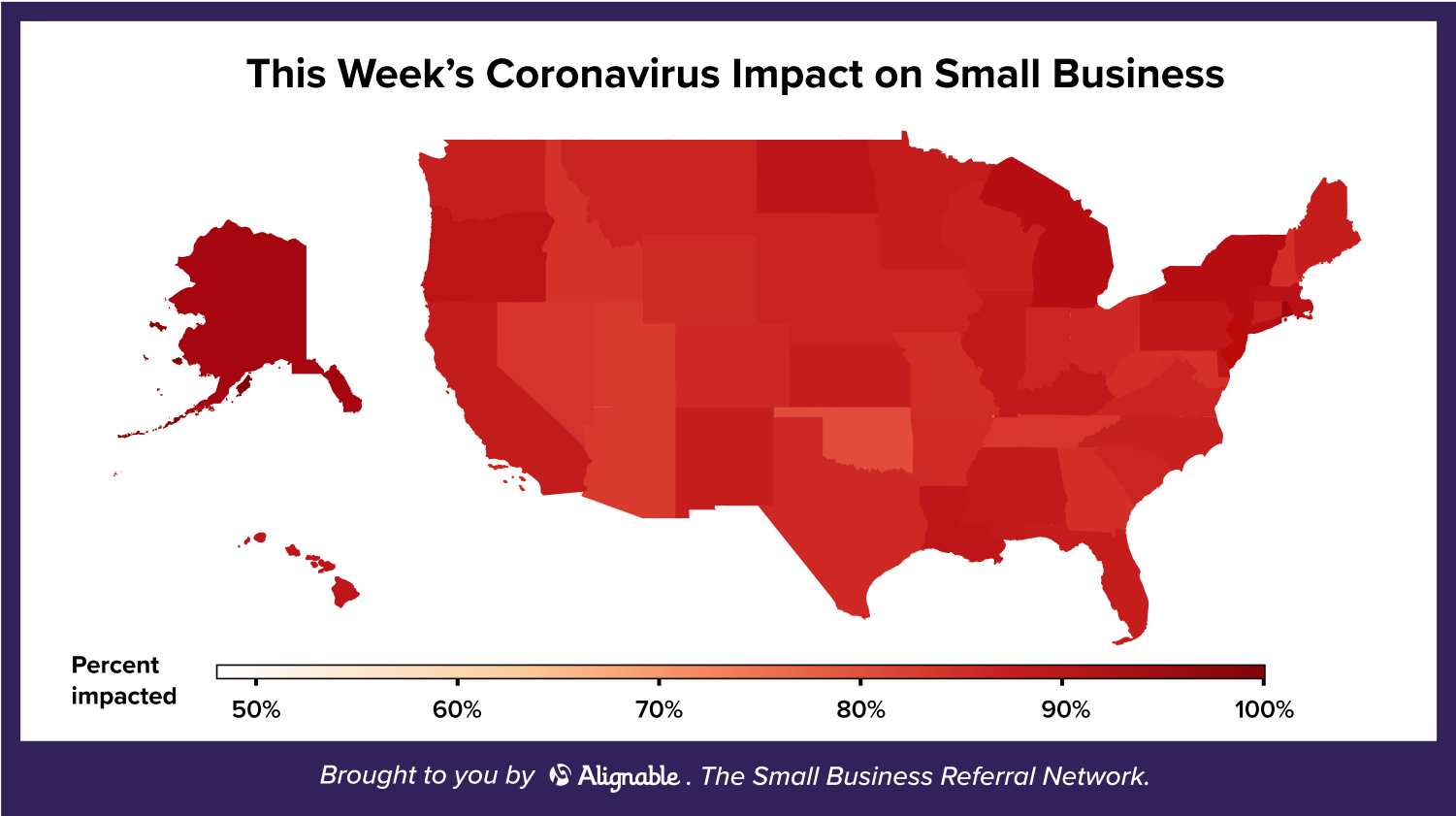

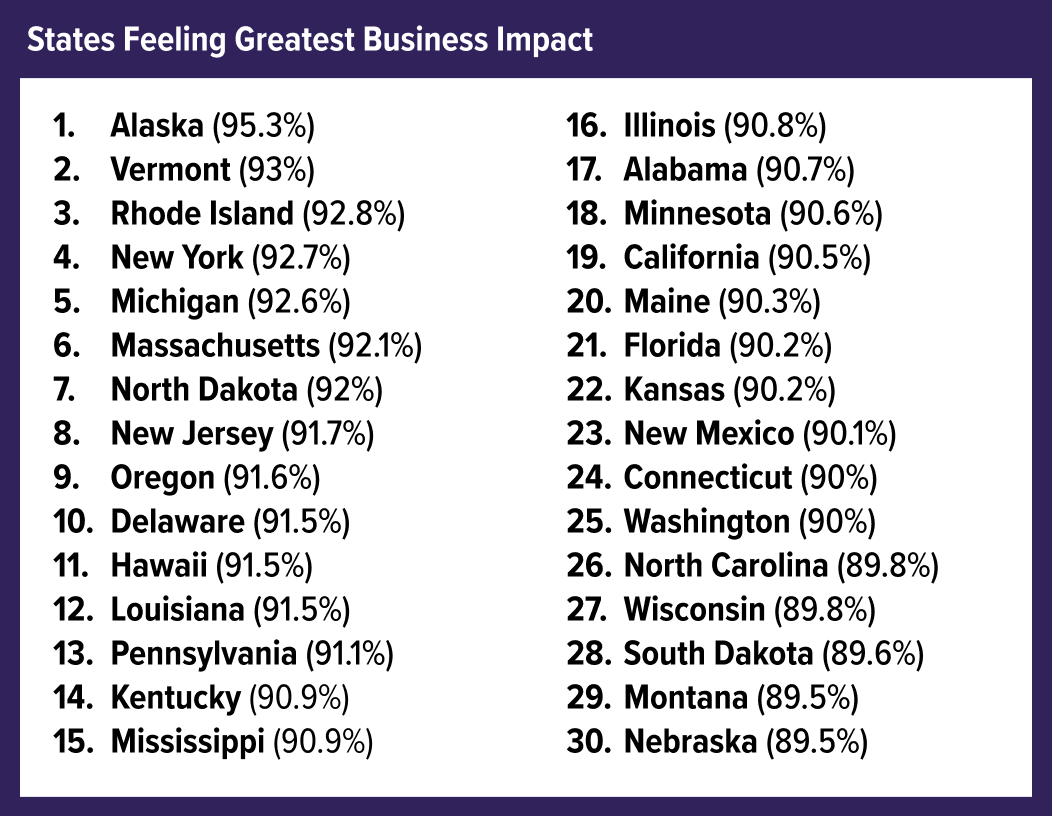

Two weeks ago, the Top 10 Most Impacted States were Alaska, Rhode Island, District of Columbia, Vermont, Washington, New Jersey, New York, West Virginia, Michigan, and Louisiana.

And here's the current list of the Top 30 Most Affected States. While six of the Top 10 from two weeks ago remain, Washington State (the first state to experience the virus) has fallen from No. 5 to No. 25, which could be a great sign of things to come for other states. (Fingers crossed!).

And the District of Columbia, which was No. 3 two weeks ago, is now No. 50!

West Virginia, which was No. 8 two weeks ago, is now No. 40. Neither one of them even made it to this chart of the most-affected states. Some things are, indeed, changing for the better.

Other states seeing improvement were Oklahoma with a drop of

9.2%, South Dakota down 5.6% and New Mexico, which shaved off

4% from its impact score last week. Some states saw

elevated impact scores, including North Dakota, Massachusetts, Oregon

and Delaware. And half of the country still has more than 90% of its small

businesses impacted by the Coronavirus.

So, to be realistic, we're still talking baby

steps here. But they're still baby steps in the right direction. Let's hope we can keep going in that direction.

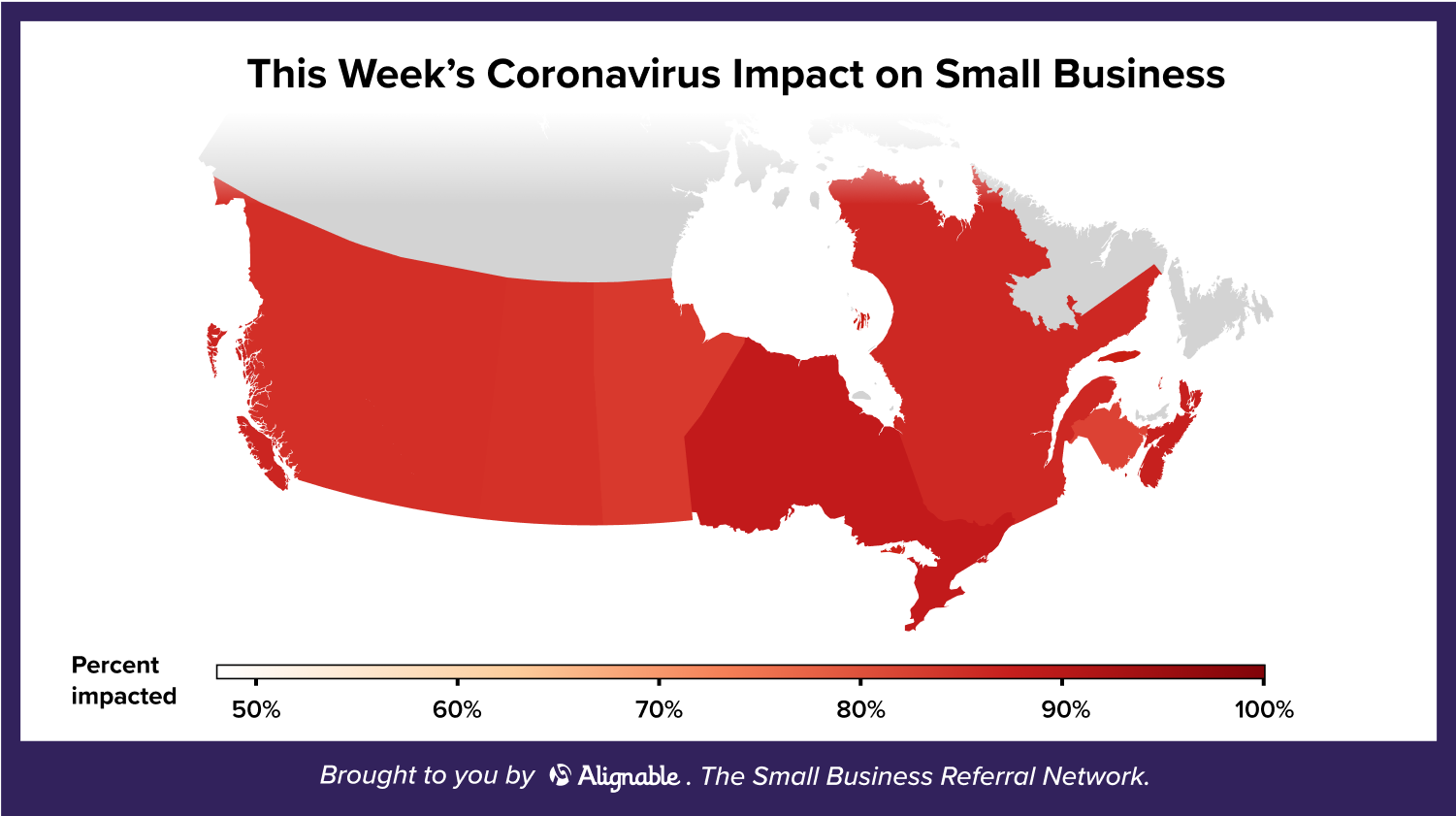

All Of Canada Is A Tad Less Impacted Than Last Week

Meanwhile, in Canada, while most of the country has provinces that range from 84% impacted to 91%, there has been a noticeable shift for some of them. First, let's talk about the week over week changes and the provinces with the most significant drops in impact: Prince Edward Island (-11.5%), Newfoundland and Labrador (-7.7%), and Saskatchewan (-4.4).

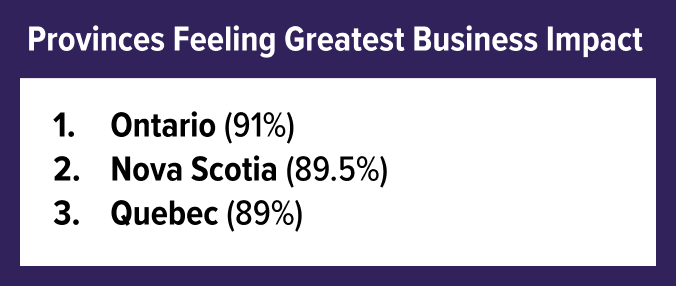

Two weeks ago, the Top 3 most-affected areas were Saskatchewan (93.1%). Ontario (91.3%) and New Brunswick (91.2%). But now, Ontario takes the top spot, holding steady around 91%, while both Saskatchewan and New Brunswick are out of the Top 3 with percentages in the 80 percentile range. And they've been replaced by Nova Scotia (89.5%) and Quebec (89%).

Again, the overall impact remains significant; however, there are some clear rays of hope emerging, at least in the numbers.

No. 1 Concern: Will Small Businesses Get The Federal Money They Need?

Along those lines, here are some questions we're investigating this week:

What's your status?

- Did you apply for CARES loans? Did you get the cash yet? Are you waiting to be approved?

- And most important, do you think the government will find a way around the current shortfall in funding?

Many people believe more money will be appropriated, so do you think it will all work out for you in the end and you'll get the money you were hoping to receive from the Federal Government?

Finally, we want Solopreneurs to know the relief funds are for them too!

So, use this chart to get your ducks in a row and prepare for another funding round.

Stay healthy and stay strong! #SmallBusinessStrong

Comments (1-10)

My business forced to shut down by the state (Car dealerships ) the service part wasn't but there is no work, people are not driving, applied for PPP supposedly was approved the day after the SBA running out of money so I'm very worried I have not laid off any employee but there is no more cleaning up to do, so if the money doesn't come quick it’s a problem. Our politicians need to start caring about the people not themselves and their pet projects that have nothing to do with the first PPP aproval.

it is dishearting to watch the greed of big business yet again give this pandemic another severe blow to small business. it is politics as usual. I have always enjoyed over my 25 years in business just creating food and desserts to make my customers happy. serving others has been my ultimate passion, my life. I should be celebrating 25 years of sharing my passion, my life, my relationships with everyone I have touched and everyone that has touched me. but that will not be the case, through no fault of my own.

First let me say economics is my passion, I studies both marketing and economics at university but economics has always been my passion. As we get deeper into the pandemic, more businesses are being affected. Even essential businesses are cutting back as demand for manufactured good drops. It is going to take those businessed that survive years to claw there way back. The vision that once we stop quarantine the economy will immediatly bounce back is a fantasy. Every company and every person is burning through reserves or increasing debt, even a 0% interest it will take years to pay it off and get back to profitabilty. A lot of businesses and people are going to have to declare that they are bankrupt, so many that the goverments will have to bail out the banks again.

I've applied for everything I can find, SBA Loan, PPP, EIDL, unemployment and I've not received any help. We are completely shut down and struggling. Meanwhile companies like Ruth's Chris received millions of dollars from a PPP loan/ grant. How is that fair? They reported earnings of 42 million last year. How many small businesses could that have helped?

We played a concert on our dock and are looking into live streaming - this is NOT what we want to do, however - we want tp get music back to the people!

We received the PPP money which is great for now but what going to happen when that ends in 8 weeks. I do not see businesses back to normal in 8 weeks. What do you all think

We are a non profit that has only one part time staff but dozens of volunteers. Our client load has doubled. We usually care for 60-65 families each day open. We now service over 150 per day. As of today with two weeks still in the month--we have had 700 families come through. Normally we offer clothing and home goods but have had to limit ourselves to food because of safety issues. Mixed in with all this we still assist clients in finding other services they need.

I am a sole proprietor and applied the first week in April. I never got a response, no confirmation. I applied again the 2nd week in April, thinking there may have been some error. Applying again is when I found out no more funds. I'm in limbo. My financial institution is not part if SBA. Calling other banks, get voice mail only and they do not return calls. I'm desperate as I recently acquired this used book store business later in life(a dream of ownershp fulfilled). I have been on every web site I can think of. Why is the House on vacation at this crucial time?

The events have been canceled that normally would have food trucks and no one is at their work spaces so parking on the street is difficult also.

I have begun to park at rest areas in ohio to help feed the truck drivers who are unable to eat at restaurants.

It's like starting my business all over again.

Very poor communication of bankers and loan officers with small business. They should come out and say why a few businesses have been funded and most have not. It’s as if they’re hiding the truth

In the meantime, they expect us to fund our employees with little chance of reimbursement, as advertised by politicians and the media. What a scam job.