Coronavirus Impact On Small Business -- Nearly One Month In

Rally Around Your Local Communities -- We WILL Get Through This Together!

Roughly one month into the Coronavirus impacting North America and the overall impact on small businesses is still around 90%, with Significant Impact stabilizing around 60%.

If we can maintain some stabilization, then that's a definite silver lining. (And we all need to see more silver linings, for sure, right?).

Here are some additional facts and figures from this week:

- 173,000+ poll responses to date: Weekly Impact Poll

- 4,800 detailed comments have been made so far (click and scroll to bottom of the page)

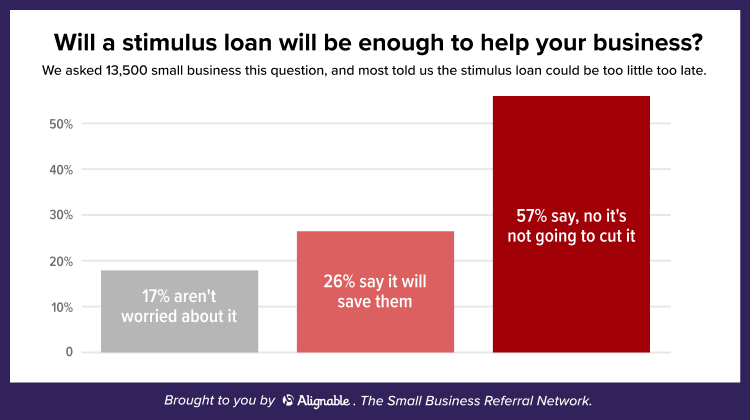

- 57% of small business owners told us that they think the CARES Act stimulus might be too little, too late

- We joined other caring tech startups in promoting the #paytoday cause, asking big companies and government agencies to please pay their small business vendors ASAP, instead of waiting a month or more

- And, by the way, have you seen the latest articles on our new Coronavirus Resource and Recovery Center? We want to help anyone who's struggling to tap the inner strength and ingenuity we know lies within every small business owner.

This Week's Recap

Impact Remains High With Some Stabilization

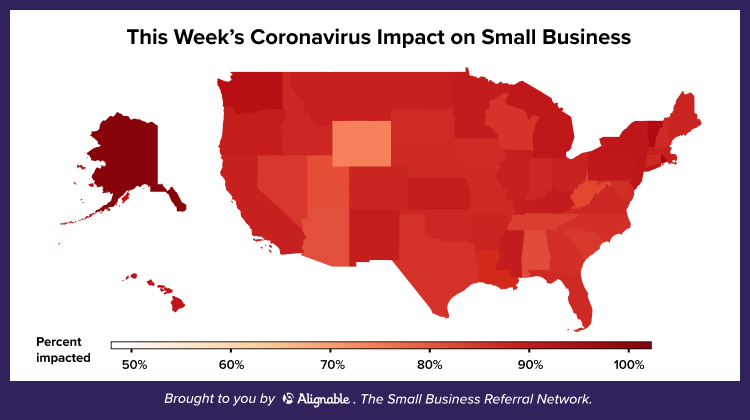

United States - Impact Across All States

Top 10 States Affected By The Coronavirus

Sending Extra Love To Alaska's Business Owners

The Ten Most-Impacted States top out with over 98% of small businesses in Alaska feeling the negative effects of the Coronavirus scare. Yes, that's right -- over 98% -- truly a devastating number. As tourism is a big industry for our friends to the far north, that state has been hit especially hard. Our hearts go out to them. (Stay strong!).

Wyoming is the state reporting the fewest effects, but still 77% of small businesses there are reporting some impact. That's a big number, too.

Meanwhile, every other state in the U.S. is experiencing impact levels north of 80%, with 20 states now reporting 90% or greater impact. That means the 10% or 20% of small businesses anywhere reporting no impact are truly the lucky ones. (Remember, always look for the silver linings).

Canadian Business Owners Are Really Feeling It, Too!

Top 3 Provinces Affected By The Coronavirus

Across Canada small business owners are feeling the impact with Saskatchewan showing the highest impact level at 93% followed by Ontario 91% and New Brunswick at 91%. All of the Canadian Provinces are reporting impact rates north of 83%.

Note: areas in gray have insufficient data but for those reporting from those areas the impact is as high as the other Provinces.

No. 1 Concern Of The Week: Federal Funding Might Not Heal The Majority Of Small Businesses

Question We're Looking into this Week:

Highly connected communities recover from natural disasters faster. What are you doing now to improve your communities response time when the dust settles?

Final note: Be sure to see our interview with the Former Head Of The Small Business Administration Karen Mills. She has some great advice for everyone affected by the Coronavirus situation. #SmallBusinessStrong

Comments (1-10)

I think that the small business owner must think about those out there that are not working and be concerned on how they are charging their customers. A friend of mine went for an auto repair and was charged way too much for the repair because the shop believe it was warranted and was making up for lost Revenue. We all need to band together and be fair to one another in this time of crisis.

The federal government should declare a three month national “holiday” and instruct all individuals and companies to suspend all monthly payments, and extend all contracts (including mortgages) for three months. No rent owed, no mortgage payments owed. Businesses will be closed and therefore have no overhead to pay. All individuals provided with vouchers for only government declared essentials (like food, gasoline, public transportation and medicine). Therefore, no need for businesses to pay salaries during the three month national holiday. If folks have extra money they can spend it anywhere and anyway that they want. This way, government would not have to spend trillions of dollars subsidizing businesses or send money to individuals that could spend the money idiotically and wastefully on nonessential items.

The loans are dumb. Going into debt (or going into more debt) is only beneficial to the banks!

A rather grave time for all - learning how to conserve and live with bare essentials - living light(ly) - keeping a compassionate consideration for all those infected and "working" the front lines. A time for the whole country (and world) to - avoid going "outside", and rather tune-in & focus (deepen) on "going inside" one's spirit and heart. So many of us live our workplace lives on an endless conveyor belt of "ambitious drive and acquisition" to stay afloat with all the external material trappings of life - this truly is a biblical time of (tremendous opportunity) to humbly and appreciatively - self reflect and sink into the hidden gemstones (un)mined within one's being. Bring your family and loved ones with you...

I have had to close my studio for March, April and probably May. By June many of my students will be on summer vacation so probably won’t do lessons. That means 6 months shut down instead of 3 (summer vacation). Since it has been such an unusual situation I am hoping some will want to do summer lessons. I am going to try to learn on line teaching for April. Who knows, it might work.

As a travel agent my new business is nil. I am still keeping busy with cancellations and following up with refunds. Unfortunately for me, I am now working for free. Commissions are a travel agent's income. They only paid if clients travel. The positive outcome, clients know my worth. Please when you travel again if you don't book with me, please use a local travel agent. We are here for you. In a crisis you can't put a value on service. [email address]

I applied on April 3. I got a multi digit code supposedly identifying my application. I have tried numerous times including talking to my bank and no one can help me understand where my application is in the process. This is so frustrating.I typically sell fixed indexed annuity’s to seniors to help them improve their retirement income. As a result of what this virus is done to the stock market my business has gone to zero since January

Hello, as the governor gives clearer guidelines on what is considered necessary services dentistry is no exception. We are open for business (on shortened hours) for care Tuesdays, Wednesdays and Thursdays excluding elective and cosmetic procedures. We are continuing to delay hygiene care at this time and expect it to resume maybe May 1st. As the information is available to all of us, we will pass it along as we are anxious to get back to our routine schedule!

I own a farm. I cater to fine dining establishments that love to show off my produce. It will keep producing whether or not if i have customers. I am being creative and finding new customers. I am now selling to our local community.

I am adding new products which should be ready for the restaurants when this blows over. I will be here for the restaurants when they need me the most to jump start their reopening.

Stimulus loan will not help my business. I am self employed and depend on special occasions such as prom, graduation, weddings etc.. for support. I do not have employees I do the work myself.